How Does Exchange Betting Work

A betting exchange is a marketplace for customers to bet on the outcome of discrete events.[1] Betting exchanges offer the same opportunities to bet as a bookmaker with a few differences. Gamblers can buy (also known as 'back') and sell (also known as 'lay') the outcome, and they can trade in real-time throughout the event, either to cut their losses or lock in profit. Bookmaker operators generate revenue by offering less efficient odds. Betting exchanges normally generate revenue by charging a small commission on winning bets.

History[edit]

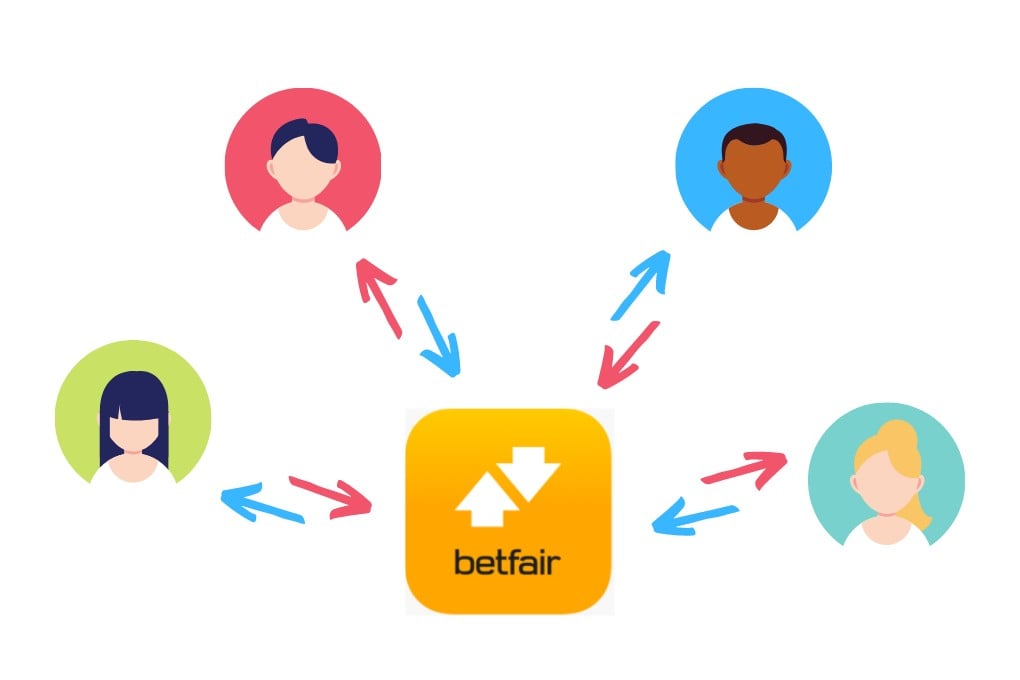

On a betting exchange, you are betting against other gamblers. Every customer on a betting exchange can decide for themselves whether to make or lay bets. They can bet on positive or negative outcomes (win or lose bets) and, crucially, they can dictate the price they are willing to accept on every bet made or laid.

The first betting exchanges were Matchbook, flutter.com and Betfair. Flutter and Betfair merged in 2001 with Betfair chosen as the primary betting exchange.[2] The flutter.com site ceased operations in January 2002.[3] Since then Betfair has maintained a leading position in the betting exchange market. BETDAQ (which also trades as the 'Ladbrokes Exchange') is believed to be the second largest betting exchange and it had an estimated 7% share of the betting exchange market in 2013.[4] BETDAQ is owned by Ladbrokes plc (now Ladbrokes Coral) following the acquisition in February 2013.[5]

Exchanges and traditional bookmakers compared[edit]

Most exchanges make their money by charging a commission which is calculated as a percentage of net winnings for each customer on each event, or market. Gamblers whose betting activities have been restricted by bookmakers (normally for winning too much money) are able to place bets of unrestricted size as long as one or more opposing customers are willing to match their bets. The odds available on a betting exchange are usually better than those offered by bookmakers, in spite of the commission charged, because there are smaller overrounds.

Online Betting Exchange

In spite of these advantages, exchanges currently have some limitations. Because exchanges seek to concentrate their liquidity in as few markets as possible, they are not currently suited to unrestricted multiple parlay betting. Betfair does offer accumulators but these are limited in number and type: users cannot determine the outcomes contained in accumulators themselves. Some exchanges such as BETDAQ also offer multiples but the exchanges act in the same manner as traditional bookmakers in doing so (i.e. they themselves and not a customer act as the layer of such bets). Exchanges also tend to restrict the odds that can be offered to between 1.01 (1 to 100) and 1000 (999 to 1).

Backing and laying[edit]

- Betting exchanges, however, don’t lay any bets themselves but instead rely on other customers to both back and lay the bets against each other. Betting exchanges charge a small commission fee on every bet placed to make their money. This fee is simply a percentage of estimated winnings.

- See full list on pinnacle.com.

- How does this work on a betting exchange? There are a number of ways a bet can be matched on an exchange. But firstly, let's look at a typical betting exchange market interface. Above we can see the Win-Draw-Win odds for an upcoming Premier League match between Tottenham and Chelsea. So what exactly are we looking at here?

Traditionally betting has occurred between a customer and a bookmaker where the customer 'backs' (bets that an outcome will occur) and the bookmaker 'lays' (bets that the outcome will not occur). Betting exchanges offer the opportunity for anyone to both back and lay.

For example, if someone thinks that Team A will win the competition, they may support that choice. The bookmaker offering this bet to the player will choose this option. Both sides will agree on the sponsor's bet and odds. If the team loses, the layer/bookmaker retains the patron's bet. If the team wins, the layer will pay the sponsor the winnings according to the agreed odds. Since every bet you make requires a patron and a layer, and the exchange of bets is not a participant in the bets made on it, any exchange of bets requires both patrons and layers.

In-play betting[edit]

Exchanges allow bets to be made in-running or in-play (i.e. to make bets while a race or match is in progress). This feature is generally restricted to the most popular events for which widespread, live television coverage is available.

Whereas non-in-play bets are entered into the system immediately after being placed by the customer, when betting in-play a time delay might be instituted so as to make it somewhat more difficult for unscrupulous customers to accept offers for bets that for whatever reason have suddenly become highly favorable. Markets may also be actively managed by the operator. In this case, betting will be briefly halted after each occurrence likely to cause a substantial change in the odds (for example, in association football matches goals, penalty kicks and sendings off would warrant such suspensions), so that unmatched bets can be cancelled.

Traders and arbitrageurs[edit]

Arbitrageurs (colloquially 'arbers') attempt to simultaneously bet on all possible outcomes to make a guaranteed profit. A trader operates similarly to an arbitrageur but is willing to take on extra risk and bet on events where no immediate profit is possible. A trader hopes to make a profit by closing out the bet at a later stage at more favorable odds. Closing out a bet for profit involves collecting more money by laying than is paid out when the outcome is backed back. If the event does not occur then no money is lost, alternatively if a trader is able to lay a higher stake at shorter odds than his back stake then he can theoretically guarantee the same amount of profit regardless of the outcome. On the other hand, if the odds move against the trader he might elect to close out the bet so as to minimise his loss. Trading can be done either before the start of an event or while the event is in progress if in-play betting is offered. Compared to trading before the event commences, trading in-play usually involves both greater risk and also the potential to make more money.

Traders can make money by betting exclusively with betting exchanges or bookmakers, or by combining the two. The trader could lay at a low amount on a betting exchange and then back at a higher price with a bookie or another exchange. This must be done simultaneously to guarantee a profit or else the opportunity could quickly cease to exist with liquid markets quickly correcting prices and bookies trying to avoid being arbitraged.

Most exchanges post the book percentages (colloquially known as the overround or 'vig') prominently for each market. These percentages are essentially the cumulative implied percentage chances of the odds on offer for each selection and for a single winner market will usually add up to more than 100% for all back selections (but only marginally over in a competitive market), and under 100% for the lay selections. This ensures that simultaneously backing or laying all selections in a market will not normally guarantee a profit. Occasionally though (especially in circumstances where odds are prone to change rapidly) exceptions will arise where offers to back or lay all selections will be made that if simultaneously and cumulatively accepted at exactly the right stakes would permit an arbitrageur to guarantee a profit. However, such phenomena tend to correct themselves very quickly and exchanges generally try to dissuade customers from attempting to take advantage of such circumstances.

Furthermore, for a trader or arbitrageur to combine different exchanges and/or bookmakers for a profit requires a substantial price differential if a profit is in fact to be made once the exchange's commission is taken into account. Even between exchanges, such large price differences are rare, brief and usually involve relatively small stakes. Fortunately for traders, almost all betting exchanges charge commission on net winnings only and charge no commission at all in the event of a net loss. This suits the trader's high turnover, low profit strategy provided he bets exclusively with a single exchange.

Unless a trader is willing to accept the risks inherent with in-play trading, the profit or loss for a trader will typically be no more than 10% of the total amount of his combined back and lay stakes in any particular market, so to make meaningful amounts of money a trader needs to commit a relatively large amount of capital. The trader therefore runs the risk of having a large unwanted bet on an event if he is unable to close his position before the event starts (e.g. if there are technical problems with his Internet connection or with the exchange).

Traders and arbitrageurs are often credited with 'seeding' markets with more competitive prices than would be present without them. However, Betfair's imposition of a premium charge in September 2008 was seen by some as being directed at the most skilled traders, whom it is speculated trade for a loss very infrequently and thus would otherwise pay little in the way of commission. In response, rival exchanges have pledged not to introduce similar charges, perhaps in hopes of enticing traders to move their business (and capital) elsewhere.

Controversy[edit]

The fact gamblers can lay outcomes on the exchanges has resulted in criticism from traditional bookmakers including the UK's 'Big Three' - Gala Coral Group, Ladbrokes and William Hill. These firms argue that granting 'anonymous' punters the ability to bet that an outcome will not happen is causing corruption in sports such as horse racing since it is much easier to ensure a horse will lose a race than to ensure that it will win.

How Does Online Betting Work

Exchanges counter that, while corruption is possible on any gambling platform, the bookies' arguments are motivated not by concern for the integrity of sport but by commercial interests. Exchanges also assert they are well aware of who their customers are and keep a complete record of all betting activity in case of enquiries, whereas high-street bookies take anonymous cash bets. Furthermore, customers can monitor the odds on the exchanges' user-friendly platforms independently. Exchanges and the authorities can be immediately alerted should suspicious betting patterns become apparent. Some exchanges have signed agreements with governing bodies of sport including the Jockey Club, with whom they insist they will co-operate fully if the latter suspects corruption to have taken place. Exchanges have co-operated with police investigations when asked to do so, sometimes leading to arrests.

In February 2013, Ladbrokes (now Ladbrokes Coral) acquired BETDAQ, which is a betting exchange. Of the UK's 'Big Three' only William Hill doesn't own a betting exchange.

See also[edit]

References[edit]

- ^http://news.bbc.co.uk/2/hi/uk_news/7109494.stm

- ^Goodley, By Simon. 'Betfair buy spells the final flutter'. Telegraph.co.uk. Retrieved 2017-06-19.

- ^Wood, Greg (2002-01-16). 'Flutter's departure leaves bitter taste'. The Guardian. ISSN0261-3077. Retrieved 2017-06-17.

- ^'Ladbrokes acquires Betdaq betting exchange for €30m'. 2013-01-25. Retrieved 2017-06-17.

- ^Percival, Geoff. 'Ladbrokes acquires BETDAQ betting exchange for €30m'. The Irish Examiner. Retrieved 2013-01-25.

A betting exchange is a platform for peer to peer gambling, that means punter-to-punter and not punter-to-bookie. The best betting exchange by far is Betfair. Now they have two platforms: a sportsbook and an exchange, both for staking bets – it’s just betting, so don’t get put off by the thought of it being complicated, it’s just another form of gambling.

What is exchange betting and how does it work?

Exchange betting is a punter-to-punter process where, instead of betting with a bookie, your bet is actually taken on by another members of the exchange community. Therefore, theoretically you can have a bet with your friend, where he or she puts up the cash that you can win should your bet be successful. In this scenario you are backing a bet and your friend is laying the bet.

The betting exchange is the portal in which these bets take place, so on one side of this process you have all the punters who chose to ‘back’ the bet and on the other side are punters who refute the bet and chose to ‘lay’ it.

Here’s an example: Man Utd play Luton in the FA Cup. They are so likely to win, that the market suggests they are 1/10 odds. If you’re not familiar with odds, that means you will need to deposit £10 into a pot in order to bet on Man Utd winning to get only £1 back (plus your tenner, minus commission).

If you think Man Utd may lose or draw, you can lay that win market. That means that you can put £1 into the pot in order to claim the other person’s £10 if United do not win. An exchange process is available on most markets and Man Utd to win is a single market. To lay that market you are simply suggesting that Man Utd will not win that match, so it may be a draw or they lose and you will have successfully laid that bet. A betting exchange is imperative if your arbitrage betting, so you’re looking for a range of odds and frequent changes to create your arb betting scenario and lay your bet.

Why use a betting exchange?

Betting exchanges tend to attract sharper players looking for an advantage but even for the casual punter, there’s one big plus point – the odds are almost always better than sportsbooks. This is because, a bit like a stock exchange, a betting exchange like Betfair features punters competing with the prices and, the more volume there is, the more fierce the competition, and the better it is for the punters.

Betting exchange vs Sportsbook

How Does Exchange Betting Work In Mumbai

First up, let’s establish if you are betting or laying. Betting you are backing the result, laying you are refuting the result. Let’s assume you are betting, the difference in sportsbook betting is that your bet is taken on by the bookie and in 99.99% of the time it is accepted and placed.

On an exchange you are betting with members of the public who are not linked to the main operator. So on the Betfair exchange for example, you are NOT betting with Betfair. For a bet to be placed on an exchange, enough people need to have laid your chosen result for there to be money in the pot available should you win. Once there is enough money in the lay pot to cover your bet, it is placed. This is called matched, therefore your wager is placed and your bet is matched.

On Betfair, your bet can sometimes stay in a state of pending until the pot builds up enough to match your bet. They have alerts, options & settings available for you to decide how the matching system works for you, how long to leave it pending etc. This is not ‘Matched Betting’ which is scheme cooked up by savvy gamblers using the exchange to profit from bonus promotions.

You can’t lay bets on a sportsbook, so you can’t pick a horse to lose a win bet, or you can’t pick Man Utd to lose against Luton from our earlier example. There are ways of achieving a similar circumstance like a Luton Draw or Win bet, but that is still considered a win bet… you have not laid Man Utd in this scenario.

What’s the difference between an exchange and a bookmaker?

A bookmaker is a single person or company willing to take your 1 bet, providing you odds and paying you out if your bet wins. On exchange as it happens you may actually have hundreds of bookies and/or members of the public contributing to the pot. So in principle the exchange is simply providing the software for bookies to operate if they choose on mass, without having to set up their own service. You don’t actually know who’s paid the money in, when you win through an exchange, it’s simply a big pot of money.

Owing to the fact that lost of bookies turned to exchanges to run parts of their bookmaking businesses, the gambling commission created a new digital gambling license for those profiting from operating on an exchange to a professional capacity. So be prepared, if you intend to make your millions laying other people’s bets on the Betfair exchange (effectively being a bookie) the gambling commission might chose to investigate your activity. If you start making a steady & regular income (in the thousands), you could be seen to be running as a business.

Which betting exchange is the best?

The best betting exchange? Quite simply, it’s Betfair. While there are some Betfair alternatives, the principle relies on the community of punters willing to back and lay bets that contribute towards the pots of cash available as winnings. Without that massive community, you might struggle to get your bets matched. So with that in mind Betfair being by fair the biggest community is our recommendation – don’t even bother looking elsewhere!

Whats the best betting exchange app?

Betfair has the best exchange app and can be downloaded from their website, from the Apple App Store and via Google Play for Android devices. You can also check compare betting apps in our review article.

Does it cost money to use an exchange?

Yes it does, you’re not betting with the operator so they need to make a fee for the luxury of you using their software. They normally take a commission upon the completion of a wager. So if your bet wins and pays out, they normally take a small cut as a commission.

What does trading on the exchange mean?

Trading on the exchange is simply a term used to highlight how a market is doing on the exchange as opposed to trackside with bookies or an online sportsbook. If you ever watch ITV horse racing (or Channel 4 racing before that), you might hear a presenter suggest that the price (odds) of a horse are trading better on the exchanges than with the touts. That’s mainly because information travels differently online and often the exchange is the first to react in moving prices. So much so that nowadays, the exchange like Betfair is the focal point for all other bookies when pricing up their own markets.